In a rapidly evolving labour market propelled by the latest generational shift, the insurance industry faces a pivotal challenge: attracting – and retaining – the next generation of talent.

Each generation is distinct, molded by the technological, societal and global influences of their formative years. When it comes to work, the younger generations, characterized by their technological prowess, desire for purpose and unique socio-economic pressures, demand a different approach.

With Baby Boomers retiring, Millennials stepping into leadership roles and Generation Z (those born roughly between 1995 and 2012) entering the workforce, insurance must evolve to meet their expectations and implement forward-thinking practices that ensure the industry not only survives, but thrives, today and in the future.

Talent acquisition and retention in insurance has reached a transition point

We are in the midst of a monumental shift. According to a report from McKinsey, Generation Z will account for nearly 25% of the global workforce by 2025.

While all industries are grappling with the introduction of younger generations, the insurance industry has struggled more than most: as the number of Baby Boomers who make up a significant portion of the insurance industry today retire at increasing rates, the need for younger workers to fill these positions rises.

Yet, the data is clear – while the Canadian insurance industry experienced a 30% rise in new job postings in Q1 2024, younger generations aren’t all that interested. In fact, a 2020 study by ACORD found that fewer than 4 per cent of millennials would consider working in insurance.

Gen Z’s expectations are high – and rightfully so

To attract younger talent, we must first understand their views on work. Gen Z’s expectations are notably higher than those of previous generations, but there are clear reasons for this shift.

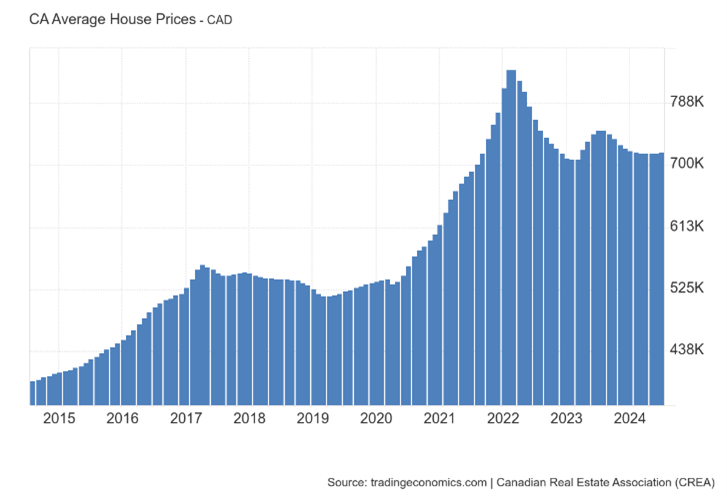

One of the biggest factors are the immense financial pressures they face, driven by rapidly rising living costs and stagnant wage growth. For many young people, the escalating cost of housing has made homeownership a distant dream. This economic reality forces Gen Z to navigate a difficult financial landscape, leading to widespread feelings of disillusionment and stress.

While some hiring managers may view Gen Z candidates who frequently change jobs as lacking loyalty, the truth is more complex. Job-hopping is a necessary strategy to achieve financial stability, especially in a high-cost market, and the financial benefits of switching jobs can be substantial. Especially for those aspiring to afford property in Canada’s major cities. Workplace perks only go so far; if Gen Z workers feel underpaid, they won’t hesitate to seek better compensation elsewhere.

Another major factor is Gen Z’s access to information through the internet and social media, which has had a profound impact on their expectations when it comes to employment. The internet allows Gen Z to compare companies and work cultures at a scale that was unimaginable only 15 years ago – platforms like Glassdoor and LinkedIn allow Gen Z to easily research company culture, pay scales, benefits and employee experiences, giving them clear benchmarks for what a good employer looks like while making them less tolerant of subpar work environments.

This information sharing has also led to a prioritization of transparency, especially pay.

Look no further than the ‘The Hard Market’, a popular Instagram account among insurance professionals which posts about the industry and shares funny, relatable ‘memes’. The page has also aggregated thousands of compensation details across the industry by profession and by geography. The sharing of this data is helping individuals determine how they are paid relative to their peers, while highlighting inequities that exist in pay gaps by gender, experience, race and age.

Pay transparency is not provincially mandated anywhere in Canada, but employers need to be operating under the assumption that the information is already out there. If you’re paying less than the industry average, or if clear pay inequities exist, you’ll have a hard time retaining young talent.

Adapting to the modern workforce

If we can appreciate the challenges faced by Gen Z, we can more readily adapt to their mindset in the working world and evolve to meet these new demands.

Embracing change and innovation

To stay competitive, insurance must be open to change and innovation. Gen Z rejects the notion of “this is how it’s always been done,” and seeks dynamic, forward-thinking workplaces that are willing to evolve. By reducing unnecessary bureaucracy, embracing new ways of working and fostering a culture of innovation, the industry will be better equipped to attract and retain Gen Z talent.

Supporting the digital transformation

Gen Z is the first generation to grow up entirely in the digital age, making them exceptionally proficient with technology. To attract young workers, the insurance industry must embrace the digital transformation and position the industry for future success.

Adapting compensation structure

In addition to offering competitive pay, the insurance industry must rethink traditional compensation structures. Armed with an abundance of information, Gen Z is a generation that is not afraid to assert their demands. This necessitates a shift in the industry’s conventional structure – one that prioritizes pay transparency and results-oriented compensation models where employees are rewarded for performance rather than seniority.

Insurance must do a better job of selling itself

Those of us that have worked in insurance appreciate what an exceptional industry it is, so why do we have such a tough time selling it to younger generations? We need to take a different approach and appeal to what younger generations value.

The perception that insurance is outdated, stagnated or ‘boring’ compared to fields like tech or finance has contributed to a lack of interest in it as a career. In reality, the insurance industry is well-equipped to attract young talent because, above all else, this generation values careers that offer a sense of purpose and tangible impact. Particularly as it faces some of today’s most pressing global challenges, our industry is uniquely positioned to appeal to this mindset.

Climate change, for instance, is a major concern for Gen Z, and insurance companies are at the forefront of addressing its consequences. Through expertise in risk management, resilience building and community protection, insurers play a crucial role in combatting climate change by helping individuals, businesses and communities prepare for, mitigate and recover from the increasing frequency of environmental threats.

The adage of ‘I fell into insurance’ is far too common – it’s time to end the self-deprecation and humility with which we often speak of our industry and start approaching it with a greater sense of pride. By showcasing how insurance contributes to the greater good, we can appeal to purpose-driven Gen Z’ers, who are eager to make a positive impact on the world.

Baby Boomers are retiring – we need minimize the brain drain our industry is set to face

Another pressing concern contributing to the industry’s talent crisis is the imminent ‘Brain Drain’. As Baby Boomers who make up the bulk of the current workforce retire, it’s critical to facilitate a smooth transfer of knowledge to younger generations.

With 8.5% of the workforce set to retire within the next 5 years, the industry faces a significant loss of expertise. To address this, companies should consider establishing formal mentorship programs and explore flexible part-time or contract roles for retiring professionals.

These initiatives would not only retain valuable industry knowledge but also allow seasoned experts to guide the next generation of talent.

Ensuring the future of insurance

Understanding the socio-economic challenges faced by Gen Z is one thing, but truly empathizing with it is another. Authentic and proactive evolution will be crucial for the insurance industry over the next decade, as it races to address a looming talent crisis.

The successful integration of Gen Z into the workforce is a necessity for the continued growth and resilience of the insurance sector, and adapting compensation models, fostering a flexible and inclusive workplace culture and embracing innovation will be key steps in this transformation. Insurance should also capitalize on its strengths by highlighting the purpose-driven nature of its work.

By addressing these areas with genuine intent, the insurance industry can attract the next generation of talent while positioning itself as a modern, dynamic and forward-thinking sector that aligns with the values of Gen Z, ensuring our long-term success and relevance in a rapidly evolving world.

Christopher Kelen, MBA, CRM, is vice-president, Canada East (Ontario, Quebec & Atlantic Canada), at Markel.