The number of Canadians enrolled in registered pension plans grew by 293,500 to reach 7.2 million in 2023, marking a 4.2% increase that outpaced overall employment growth across the country.

The latest data from Statistics Canada shows pension plan membership expanded faster than the broader job market, which grew by 3.8% over the same period. The pension coverage rate—the share of all paid workers with a registered pension plan—rose to 37.7% in 2023 from 37.5% the previous year.

Women continued to represent the majority of pension plan members, accounting for 51.3% of total membership at 3.7 million participants. Male membership reached 3.5 million, with both groups seeing similar growth rates of approximately 4.2%.

Ontario leads provincial growth

Ontario added the most new pension plan members with 161,800 participants, followed by Quebec with 54,800 new members. British Columbia and Alberta also saw significant increases of 32,000 and 18,700 members respectively. Manitoba was the only province to see a decline, losing 1,300 members.

The growth occurred across both public and private sectors, though with different patterns. Public sector plans added nearly 169,000 participants for a 4.5% increase, reaching 3.9 million total members. Private sector plans grew by 125,000 members or 3.9%, surpassing 3.3 million participants.

Defined benefit plans maintain dominance

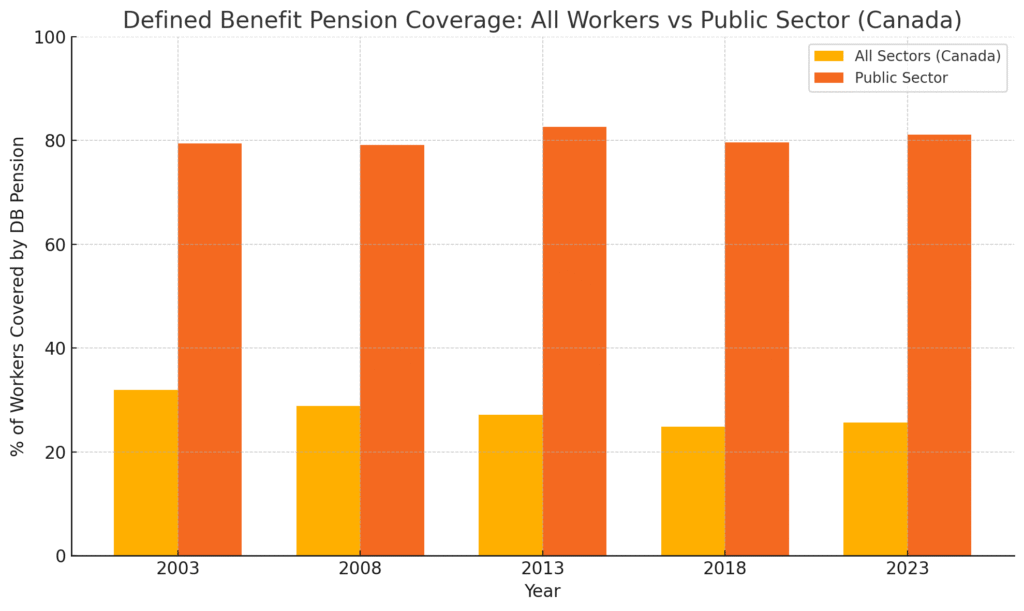

Defined benefit plans, which guarantee specific retirement payments based on salary and years of service, continued to dominate the pension landscape. These plans covered 4.9 million workers in 2023, representing 68.1% of all registered pension plan membership—unchanged from the previous year.

Defined contribution plans, where retirement benefits depend on investment performance rather than guaranteed formulas, added 65,300 members for a 5.1% increase. These plans now account for 18.6% of total membership, with most participants (86.7%) working in the private sector.

Other plan types, including hybrid and composite arrangements, grew by 28,400 members to reach 963,200 participants, representing 13.3% of total membership.

Sector differences highlight employment trends

The data reveals distinct patterns between public and private sector pension participation. In the public sector, women made up 63.8% of new plan members, adding 107,800 participants compared to 61,100 new male members. Twenty of the 23 largest public sector plans in Canada now have more women than men.

Private sector growth showed different dynamics, with defined benefit plan membership increasing by 2.8% while defined contribution plans expanded by 5.5%. This suggests employers in the private sector continue to shift toward variable-benefit arrangements that transfer investment risk to employees.

Contributions and assets reach new highs

Total contributions to registered pension plans increased by $2.9 billion to reach $79.3 billion in 2023, representing a 3.8% increase from the previous year. Employee contributions accounted for 40% of this total at $31.7 billion, while employer contributions for current service represented 54.8% at $43.4 billion.

The market value of pension plan assets grew by $56 billion to nearly $2.4 trillion. The largest 36 plans, each with 30,000 or more active members, held 61.5% of total assets while accounting for 54.6% of total membership.

Coverage rates improved for both men and women in 2023. Women’s pension coverage rose 0.4 percentage points to 40.9%, while men’s coverage increased by 0.1 percentage points to 34.8%.