A new rating from Expert Consumers has placed QuickBooks Payroll at the top of its small-business payroll software rankings, citing features such as automated tax filing, integration with accounting tools, and flexible pricing tiers. The recognition, released Tuesday by the Boston-based research group, comes as employers increasingly turn to digital tools to manage complex workforce needs and ensure compliance.

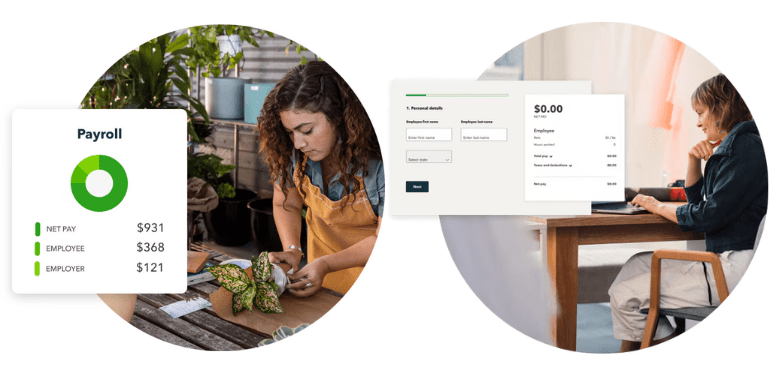

Expert Consumers said QuickBooks Payroll’s appeal to small firms lies in its ability to reduce paperwork and streamline administrative tasks. “Simplify payroll with QuickBooks—accurate, efficient, and tailored for small businesses,” the source said. “Focus on growth, not paperwork.”

According to Expert Consumers, the platform’s features include unlimited payroll runs, automated tax filing, and quick integration with QuickBooks Online. Plans range from the basic Core tier, starting at $25 a month, to the Elite tier at $65, which includes tax penalty protection of up to $25,000. Expert Consumers said the platform’s time tracking and HR advisory tools are designed to help employers handle day-to-day operations more efficiently, while integrated benefits options add another layer of support for managing a workforce.

The firm’s assessment also highlighted the option to bundle payroll services with accounting plans, offering various combinations at different price points. Expert Consumers noted these bundles can help businesses gain a fuller view of costs, track expenses, and maintain compliance with tax requirements.

Expert Consumers, an affiliate marketer that may earn commissions from sales, said the rating reflects shifting trends as small businesses rely more on integrated, automated solutions. Its endorsement, the group said, aims to help employers identify tools that can adapt as their operations grow and requirements change.