The federal government will introduce a $1,100 refundable tax credit for personal support workers in Budget 2025, affecting more than 200,000 care workers across Canada.

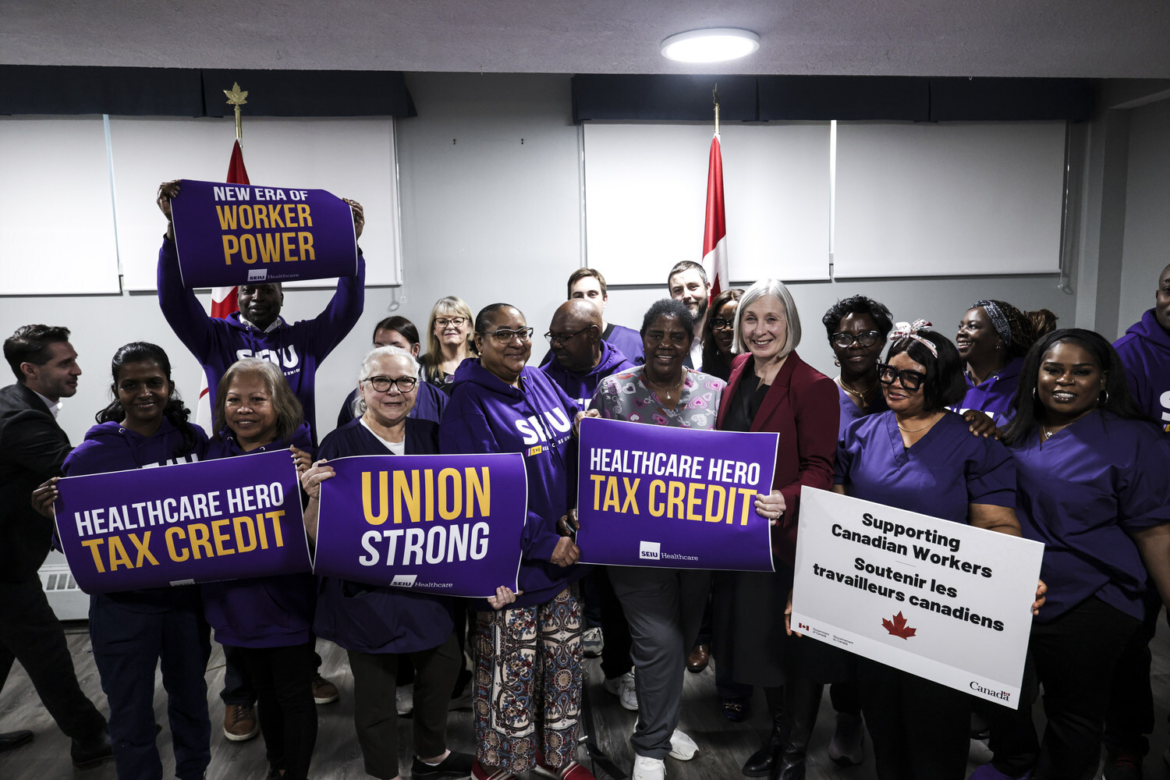

Minister of Jobs and Families Patty Hajdu announced the Personal Support Workers Tax Credit on Oct. 27 in Richmond Hill, Ont., alongside SEIU Healthcare, which represents more than 68,000 healthcare workers in Ontario.

The refundable credit targets low- and modest-income care workers. SEIU Healthcare first proposed the measure in November 2024, and Prime Minister Mark Carney adopted it as part of his election platform.

Addressing workforce affordability challenges

According to SEIU Healthcare, many PSWs live near or below the poverty line and work multiple jobs while caring for vulnerable populations. The union said the credit aims to improve retention in the sector by making employment more financially sustainable.

“When SEIU first called for this tax credit, we did so because personal support workers and care workers like them deserve to live with dignity and economic security,” said Tyler Downey, president of SEIU Healthcare. “Putting more money directly into the pockets of PSWs will support retention and help strengthen care for Canada’s seniors.”

The announcement comes as Canada faces challenges in staffing its healthcare system amid an aging population.

Government commitment to care workers

Hajdu said the measure reflects federal investment in the healthcare workforce. “Personal support workers are the backbone of our healthcare system,” said John Zerucelli, secretary of state for labour. “They help our loved ones live and age with dignity.”

The tax credit will be included in the upcoming federal budget. Budget 2025 has not yet been tabled in Parliament.