Payroll employment in Canada grew by 32,800 positions in July 2024, a 0.2% increase from the previous month, according to data from Statistics Canada. This uptick followed a decline of 22,900 in June, and marked a continuation of overall growth seen in the first half of the year. On a year-over-year basis, payroll employment has risen by 157,700, or 0.9%.

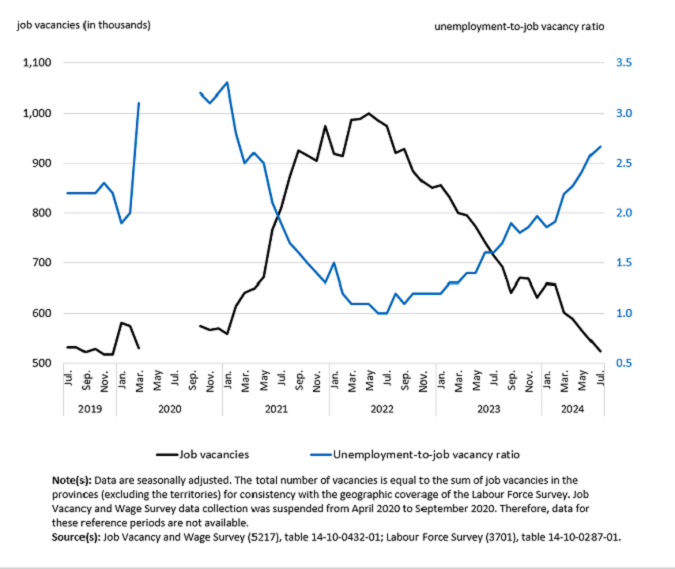

Job vacancies, however, continued to decline for the third consecutive month, falling by 22,400 to 526,900 vacant positions in July, a 4.1% drop from June. This represents a nearly 50% reduction from the record high of 1,003,400 vacancies in May 2022.

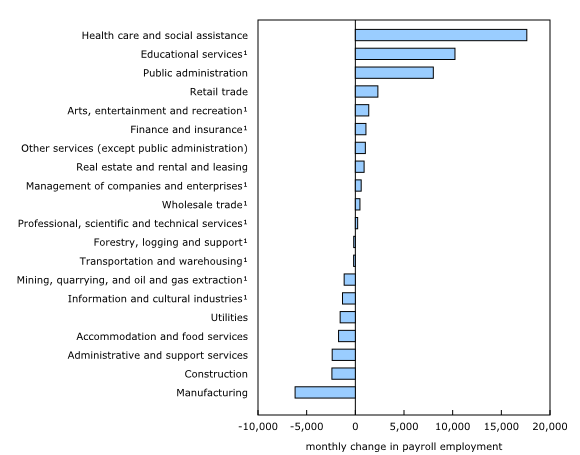

The gains in payroll employment were concentrated in five of 20 sectors, with health care and social assistance leading the way, adding 17,600 jobs, a 0.7% rise. Public administration (+8,000, +0.6%) and retail trade (+2,300, +0.1%) also saw notable increases. These gains were partially offset by declines in other sectors, including manufacturing (-6,200, -0.4%) and construction (-2,400, -0.2%).

The health care and social assistance sector has seen consistent growth since September 2022, with a cumulative increase of 176,600 jobs, or 8.0%. Growth within this sector has been driven largely by general medical and surgical hospitals, child day-care services, and nursing care facilities, which collectively accounted for 56% of the overall increase since September 2022.

In the public administration sector, payroll employment rose by 8,000 jobs in July, with local, municipal, and regional public administration seeing the largest gains (+3,400, +0.7%). On a year-over-year basis, payroll employment in public administration grew by 39,900, a 3.1% increase.

Payroll employment increases in five sectors, decreases in another five sectors in July

Retail trade also posted gains, reversing some of the losses experienced in June. Despite the sector’s July increase of 2,300 jobs, retail trade has been on a downward trend since peaking in February 2023, losing a net 33,400 jobs since that time. Sub-sectors such as clothing and accessory retailers, building material dealers, and furniture stores have been particularly hard hit.

In contrast, the manufacturing sector continued to struggle, with payroll employment falling for the second straight month, down 6,200 jobs in July. Declines were concentrated in food manufacturing and plastics and rubber products manufacturing.

Job vacancies declined across a broad range of sectors, with transportation and warehousing, accommodation and food services, and manufacturing experiencing the steepest drops. Manufacturing vacancies fell by 5,800 (-15.7%) in July, part of a continuing downward trend that began after vacancies peaked in April 2022.

Accommodation and food services saw a reduction of 6,500 vacancies in July, bringing the total to 51,400. This sector has been one of the hardest hit by declining vacancies, down 41.7% on a year-over-year basis and more than two-thirds below its peak in September 2021.

Unemployment-to-job vacancy ratio rises as vacancies fall

The health care and social assistance sector continued to post the highest job vacancy rate at 5.1% in July, while sectors such as transportation, warehousing, and manufacturing saw some of the sharpest decreases in vacancies.

On a provincial level, Ontario saw the largest drop in job vacancies, losing 11,900 vacant positions in July. Manitoba, Newfoundland and Labrador, and Nova Scotia also experienced declines, while job vacancies remained relatively stable in the remaining provinces. British Columbia recorded the highest job vacancy rate at 3.6%, while Newfoundland and Labrador had the lowest at 1.9%.

As job vacancies continue to decline, the ratio of unemployed persons to job vacancies has risen for the fifth consecutive month, with 2.7 unemployed persons per job vacancy in July, up from 2.6 in June.