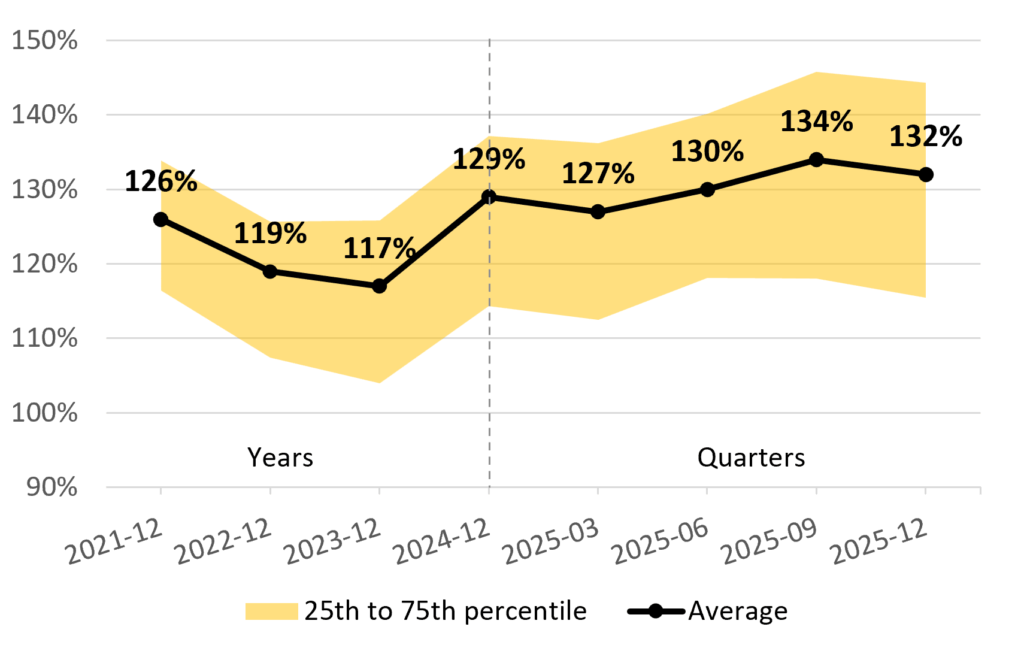

Canadian pension plans strengthened their financial positions in 2025, driven by robust stock market performance and a slight uptick in long-term interest rates, according to Normandin Beaudry’s latest pension plan financial position index.

The consulting firm’s index, which tracks both going concern and solvency funding bases, showed pension plan surpluses trending upward throughout the year. The going concern basis measures plans assuming indefinite operation, while the solvency basis evaluates financial position in the event of plan termination.

Fourth quarter decline

Despite the positive annual trend, pension plans saw a reduction in financial position during the final quarter of 2025. Investment returns came in slightly below expectations, and changes in prescribed interest rates negatively affected solvency-based results, according to Normandin Beaudry.

Some plans also experienced modest declines due to investment policy de-risking, increased margins for adverse deviations on a going concern basis, and surplus withdrawals.

Market volatility and recovery

The 2025 results reflected strong investment performance that generally exceeded discount rates used in actuarial valuations. This occurred despite significant market turbulence last spring when tariff disputes triggered a drop in consumer and investor confidence to levels comparable to the 2020 pandemic peak.

Financial markets subsequently recovered, demonstrating economic resilience even in countries more heavily impacted by U.S. tariffs, according to the report.

AI investment surge

The year saw unprecedented capital flows into artificial intelligence-related industries, increasing demand for energy and raw materials. China led innovation in renewable energy generation and storage, with clean energy representing approximately 90 per cent of global electricity generation growth, according to Normandin Beaudry.

The United States focused on traditional energy sectors and took steps to secure global resource access, including actions targeting Venezuela, which holds the world’s largest oil reserves.

Interest rate environment

Central banks in Canada and the United States lowered key rates throughout the year, while long-term interest rates rose slightly. This combination generally benefits pension plans through reduced actuarial liabilities and current service costs.

Upcoming mortality table changes

A new mortality table expected in spring 2026 could affect strategic planning for pension administrators. Results on a going concern basis may be impacted as of Dec. 31, 2025, according to the firm.

A new mortality improvements scale published in 2024 projects faster life expectancy growth, leading to higher pension plan costs. Most actuaries have not yet incorporated this scale into valuations, preferring to wait for the updated mortality table itself.

The combined use of the new table and scale will likely affect valuation results, though the full scope remains difficult to quantify, according to Normandin Beaudry.

Index methodology

The index projects financial data from Normandin Beaudry’s Canadian pension plan clients, excluding plans in the Quebec municipal and university sector, which are tracked separately. Assets are projected using market index performance, while going concern liabilities use estimated discount rates based on each plan’s asset allocation and sensitivity to Government of Canada bond interest rate changes.