WorkSafeBC has updated its assessable payroll practice directive to clarify how employers should report tips and wage-loss benefits, effective Jan. 1, 2026.

The changes to Assessment Practice Directive 5-245-2(A) aim to make payroll reporting more accurate and administratively efficient for employers, according to the provincial workers’ compensation board. The update does not change the underlying policy in Assessment Manual item AP5-245-2.

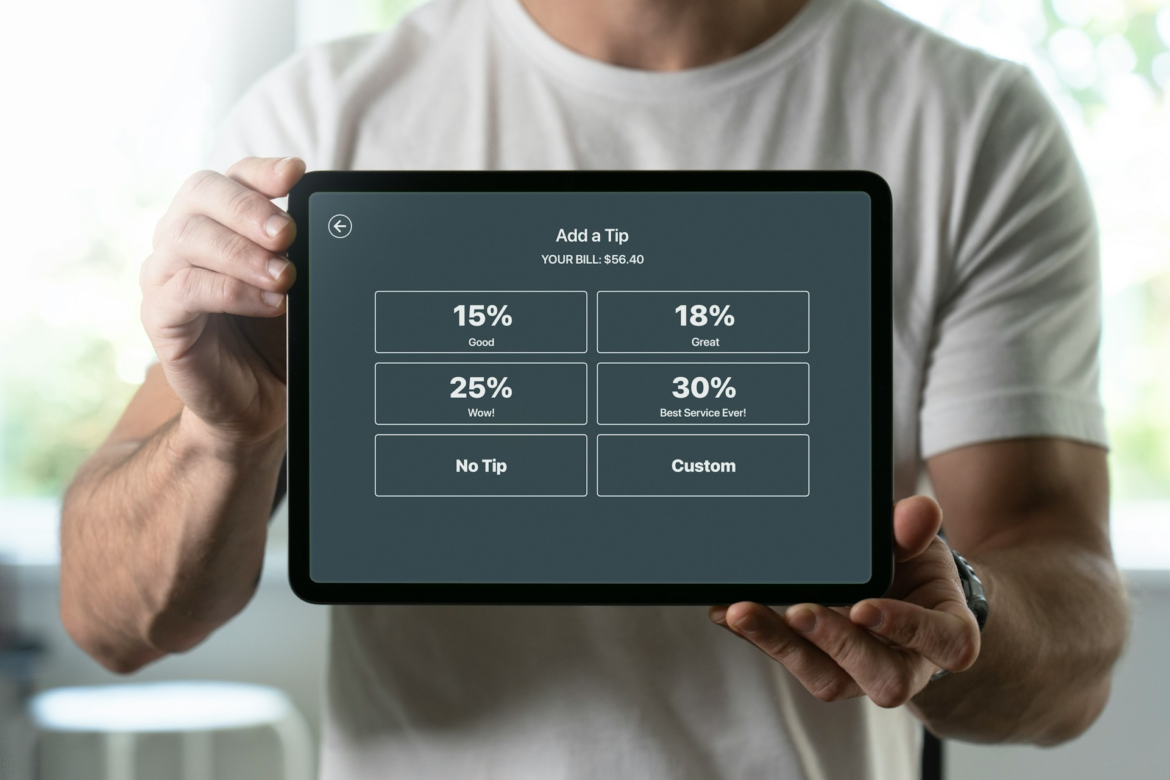

Tips limited to verifiable amounts

The directive now specifies that only tips and gratuities verifiable by the employer should be included in assessable payroll. While tips have always been included in assessable earnings, the update clarifies the scope of what must be reported.

The change aligns with practices in other Canadian provinces including Alberta and Ontario, according to WorkSafeBC.

Wage-loss benefits excluded

The directive also clarifies that paid wage-loss benefits from WorkSafeBC are excluded from assessable payroll. This applies to amounts initially paid by the employer and later reimbursed by the compensation board.

The updated practice directive applies to the 2026 assessment year onward. WorkSafeBC said the changes do not create new obligations for employers but rather define the scope of existing guidance that has been in place since 2010.